Multiple cash flow calculator

The formula for calculating operating cash flow is as follows. M Macys cash flow statement for the fiscal year ending 2019 according to the companys 10-K statement.

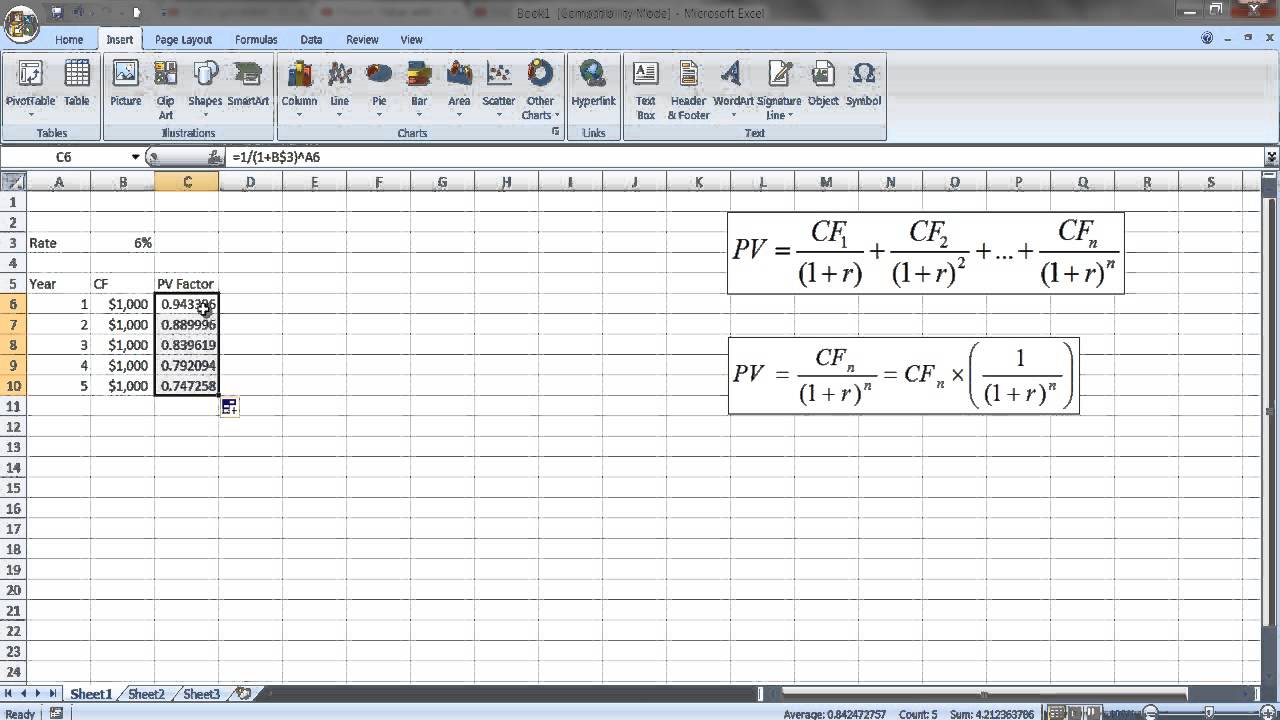

How To Use The Excel Npv Function Exceljet

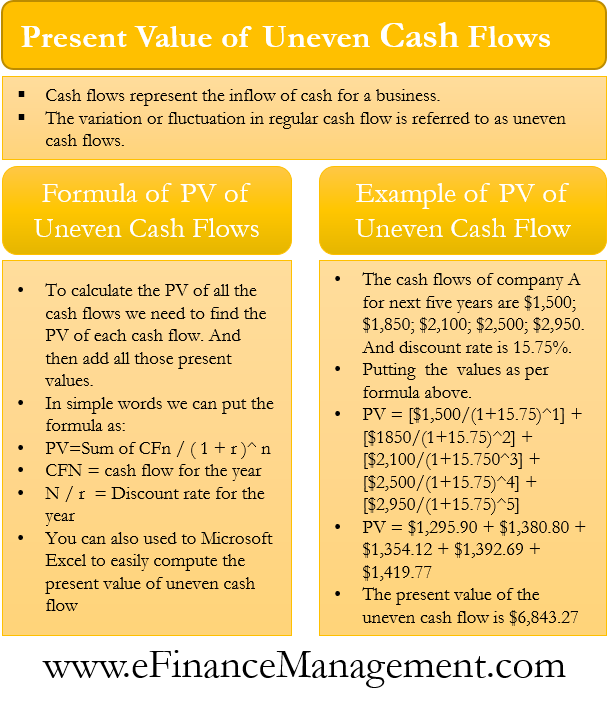

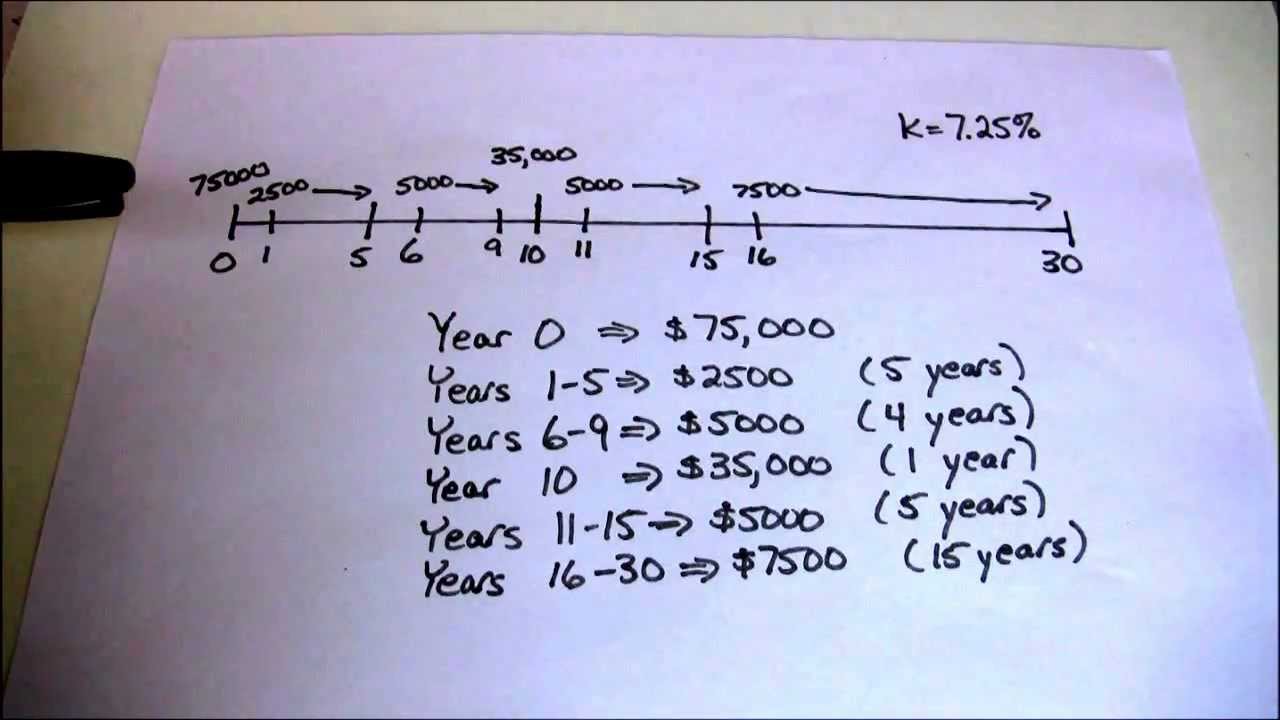

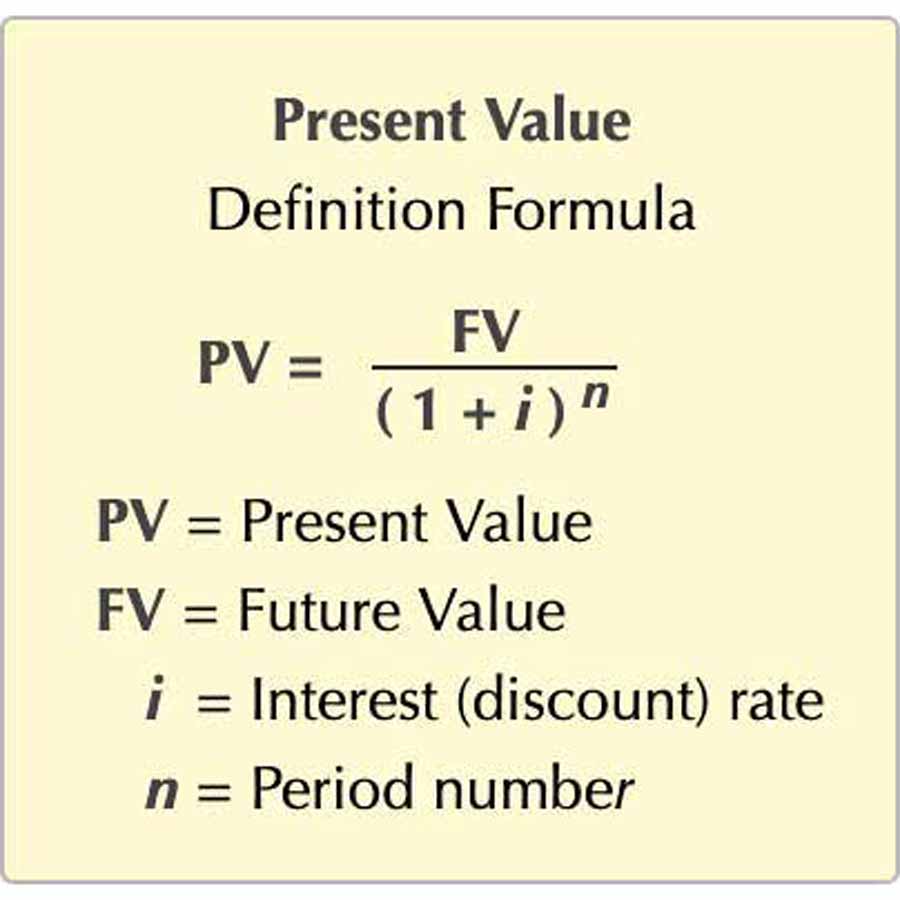

In order to find out the present value of uneven cash flows put your values in the following formula.

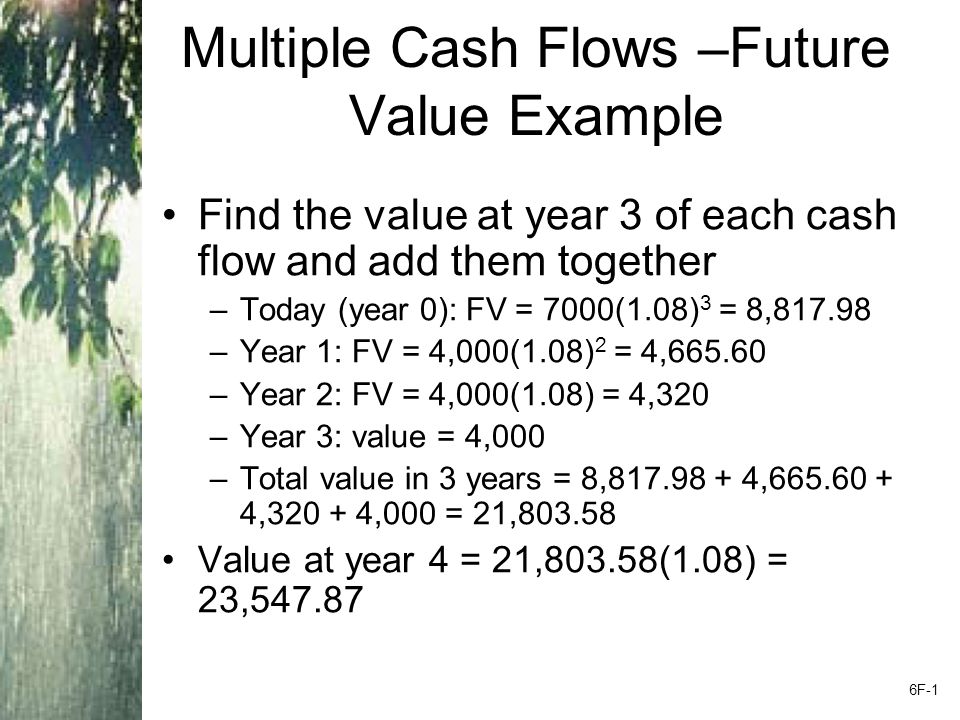

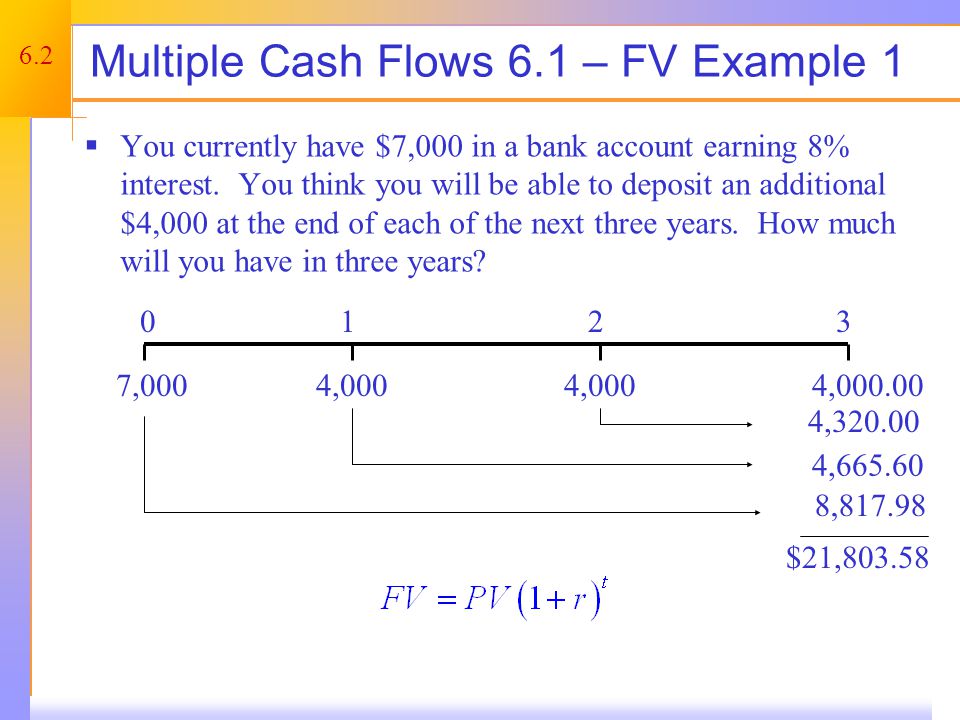

. Calculate the future value of each cash flow then add the compounded values together. If you run out of available cash you run the risk of not being able to meet your current obligations. Cash Flow Calculator Having adequate cash flow is essential to keep your business running.

Having adequate cash flow is essential to keep your business running. Operating cash flow Net income Non-cash expenses Increases in. Fathom combines business planning with powerfully simple three-way Cash Flow Planning.

If you run out of available cash you run the risk of not being able to meet your current obligations such as your payroll. If the multiple cash flows are a. The FV of multiple cash flows is the sum of the FV of each cash flow.

Since the cash flow of 60 only occurs once we can leave this at the default of 1 by pressing the button The display should now read. However annuities are old so historically we have used a simplified version of the above equation. Ad QuickBooks Financial Software.

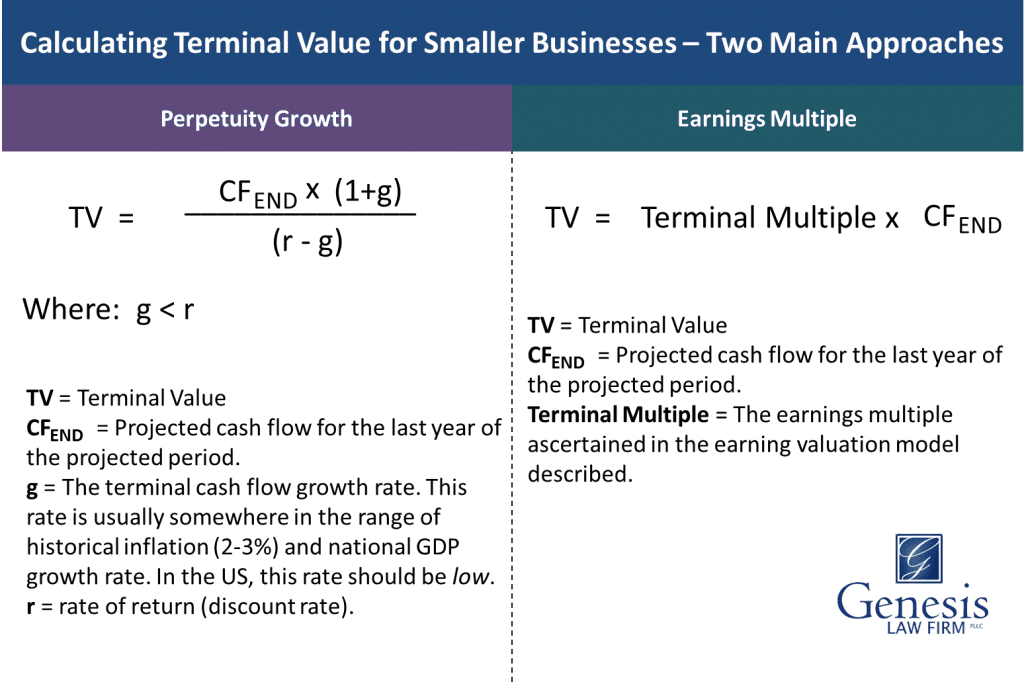

This calculation is very easy to do in a spreadsheet. Ad QuickBooks Financial Software. Since a cash flow multiple is Value divided by year-ahead Cash Flow the formula becomes CF Multiple 1 k-g.

There are two different methods for calculating the cash flow. Invite teams clients. The future value of a lump-sum of money.

Enter the second cash flow of 30 now. To sum the FV of each cash flow each must be calculated to the same point in the future. When calculating the future value of multiple cash flows using a spreadsheet you must.

Difference between deposits and withdrawals within a certain period of time. Ad Build multiple scenarios. CF for Year 1 1 r 1 CF for Year 2 1 r 2 CF for Year 3 1 r 3.

The table on the following page illustrates the relationship between the long. In order to calculate NPV we must discount each future cash flow in order to get the present value of each cash flow and then we sum those present values associated with each time. Specifically the above is equal to.

Example of Free Cash Flow Calculation Macys Inc. P V 0. Track planned vs forecasts.

Rated the 1 Accounting Solution. Rated the 1 Accounting Solution.

Ba Ii Plus Fv Of Mixed Cash Flows Youtube

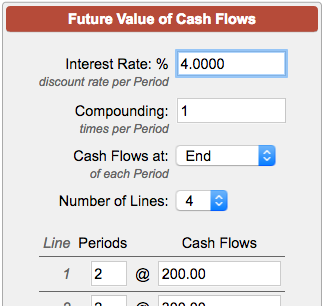

Future Value Of Cash Flows Calculator

Multiple Cash Flows Future Value Example Ppt Download

Present Value Formula Calculator Examples With Excel Template

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Chapter Outline Future And Present Values Of Multiple Cash Flows Ppt Video Online Download

Present Value Of Uneven Cash Flows All You Need To Know

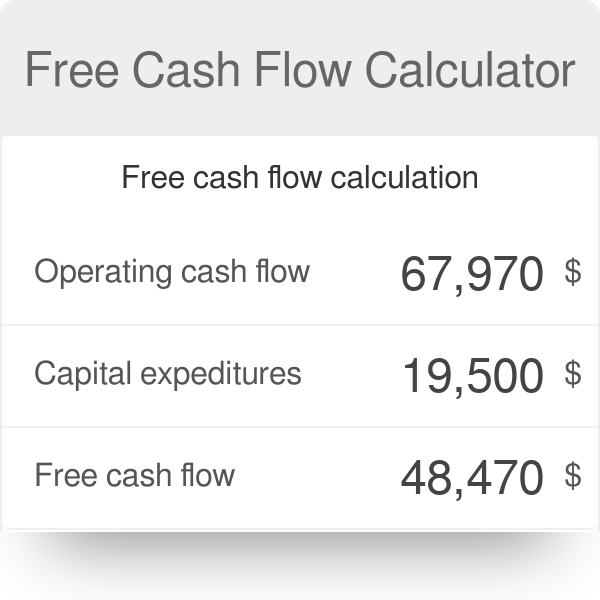

Free Cash Flow Calculator Free Cash Flow

Free Cash Flow Formula Calculator Excel Template

Net Present Value Calculator

Present Value Multiple Cash Flows In Excel Youtube

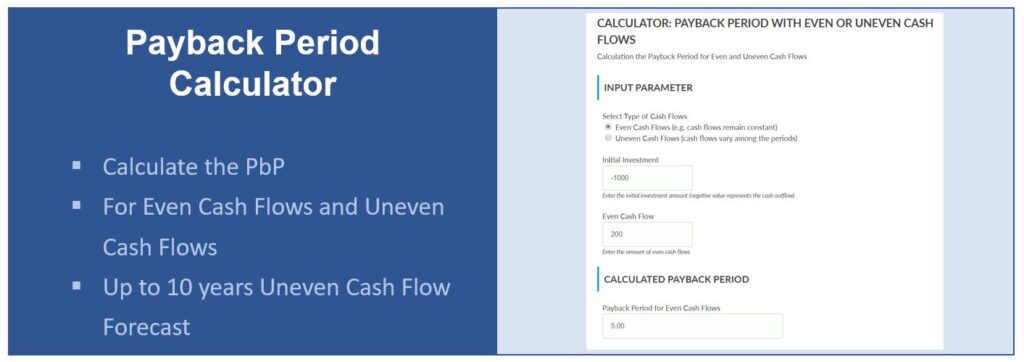

Payback Period Calculator Pbp For Even Uneven Cash Flows Project Management Info

Uneven Cash Flow Streams On The Hp10bii Youtube

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

How To Use Discounted Cash Flow Time Value Of Money Concepts

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com